COVID-19 SMALL BUSINESS RESOURCE NEWSLETTER #1

In March 2020, the United States Congress passed three bills that provide the largest financial relief package in the history of the United States. Contrary to similar packages in the past that were geared to banks and large corporations, these bills provide significant benefits to both individuals and small businesses that are impacted by the COVID-19 pandemic.

Through our affiliation with several regional and national organizations, HE Travel staff have been able to compile details about the programs now available to us, and we are delighted to share these with you.

Caveat: this is a summary of publicly available information, but all information is subject to change due to the unique dynamics of the response to COVID-19 at every level of society.

PAYMENTS TO INDIVIDUALS:

- Eligibility and payments

- Adults who earned under $75,000 in the most recent year for which taxes were filed (2018 or 2019) will receive a payment of $1200

- Any adult earning between $75,000 and $100,000 will receive a prorated percentage of $1200

- Families with children will receive an additional $500 per child under 17

- No payment will be made for anyone 17 and older who is claimed as a dependent on someone else’s tax return

- Those with a direct deposit bank account on file with the IRS will receive this first, while those being sent a paper check will likely need to wait longer

UNEMPLOYMENT INSURANCE FOR INDIVIDUALS:

- State unemployment insurance benefits continue with no changes, except that lines may be longer with more than 10 times the typical number of applicants

- The federal government is supplementing state programs with enhancements

- They will add $600 per week to unemployment benefits, on top of the amount provided under each state’s program

- Unemployment benefits can be paid out longer than under traditional state guidelines

- Unemployment insurance for Independent Contractors

- Until now, independent contractors have neither paid into, nor received benefits from their state’s unemployment insurance fund

- Under the new federal laws, independent contractors – such as on-call drivers – may now file claims for unemployment benefits

ECONOMIC INJURY DISASTER LOAN (EIDL) PROGRAM for SMALL BUSINESSES:

- This is an expansion of long-standing programs for victims of natural disasters

- Administered by Small Business Administration (SBA) and is available nationwide

- Eligibility:

- Small businesses with under 500 employees, including independent contractors and single-employee companies

- Non-profit organizations, including business associations

- Purpose:

- To provide operating funds to businesses with reduced (or no) revenue

- Funding:

- Loans are for working capital to fund any legitimate business need

- Loans can be up to $2,000,000 per entity

- Loan interest: 3.75% for for-profit businesses; 2.75% for non-profit organizations

- The typical loan is for 30 years

- Administration: streamlined process implemented on new website on 3/27/20

- Very simple registration at: https://covid19relief.sba.gov/#

- No login required – just general company information, annual income and Cost of Goods Sold (or expenses for non-profit entities)

- The SBA will follow up for more information as needed

- Operated directly by the SBA with no bank involvement

- No personal guarantee is required for loans less than $200,000

- Loans may be approved on credit scores alone

- Business owners in need may apply even if they have low credit scores

- SBA Loan Advance:

- Applicants may check off a request for a $10,000 advance on the form

- Bank information can be provided after checking off the advance request

- The SBA goal is to fund these advances within 3 days

- If the applicant is turned down for the loan, this advance is forgiven

- SBA Express Bridge Loan Pilot Program:

- New option announced in late March

- For small businesses that already have a relationship with an SBA Express Lender (800 financial institutions around the US)

- Up to $25,000 can be provided with a fast turnaround

- Applicants may be asked to show a business plan for paying back the loan

- Collateral MAY be required (home, car, inventory or other property)

- Most Express Bridge Loans will be repaid from proceeds from an Economic Injury Disaster Loan when approved

SMALL BUSINESS INTERRUPTION (PAYCHECK PROTECTION) LOANS:

- This is a new program under the CARES Act, signed into law on March 27, 2020

- Purpose:

- To allow businesses to cover qualified business expenses from March 1 to June 30, 2020 including:

- Payroll support, including sick leave and health insurance

- Employee salaries (including offsetting lost tip income for servers)

- Mortgage payments or rent

- Utilities

- Debt obligations that were incurred before the covered period

- This program essentially routes unemployment benefits through the employer, so that staff are still in place when business resumes

- To allow businesses to cover qualified business expenses from March 1 to June 30, 2020 including:

- Eligibility

- Small businesses with under 500 employees, including independent contractors and single-employee companies

- Non-profit organizations, including business associations

- Local outlets of national chains such as restaurants, hotels and motels that have fewer than 500 employees in a specific location

- Funding:

- A small business can borrow up to 2.5 times their average monthly payroll over the previous 12 months

- The intent of the law is that any loan funds used for the above “qualified business expenses” will be forgiven, but detailed criteria have not been finalized

- Any funds used for purposes other than the “qualified business expenses” will become a 10-year loan with a maximum 4% interest rate and other favorable terms

- No personal guarantee or collateral are required

- Administration:

- The federal government will manage the program, but all loans will be processed through local lenders

- All federally licensed financial institutions such as banks and credit unions are eligible to participate

- Interested business owners are encouraged to contact a financial institution where they already have a business relationship

- Within 30 days of March 27, 2020 the Treasury Department is required to provide details to lending institutions

- The stated goal is to have the first loans approved as early as Monday, April 6

- Canceled indebtedness under this program shall be excluded from gross income, and is not subject to federal tax (but could be subject to state and local taxes)

INDUSTRY-SPECIFIC LOANS:

- Included in the CARES Act signed on March 27, 2020 are additional programs to assist companies in specific industries, such as travel companies and hospitals

- Travel companies include airlines, hotels and motels, and “ticket agents” (travel advisors)

- Cruise lines are not included, perhaps because most are officially registered in small, low-tax countries, even though their headquarters are in the US, and they pay few taxes

- Details will be rolled out as various government agencies work them out

LOCAL EMERGENCY LOAN PROGRAMS:

- See the websites of your city, county and state to see if you are eligible for any locally funded loans or grants

- For example, Salt Lake City has loans of up to $25,000 for local businesses

A special thank you for compiling this information to:

- HE Travel (Philip Sheldon, Jacob McMahon, and Zachary Moses – www.hetravel.com )

- Zachary Moses for Utah Governor Campaign (www.zachmoses.com)

- Members of the NTA leadership and the NTA Owners Network

- ASTA (American Society of Travel Advisors)

- Uniglobe Travel Center

- National LGBT Chamber of Commerce

- Utah Gay & Lesbian Chamber of Commerce

USEFUL WEBSITES FOR BUSINESSES

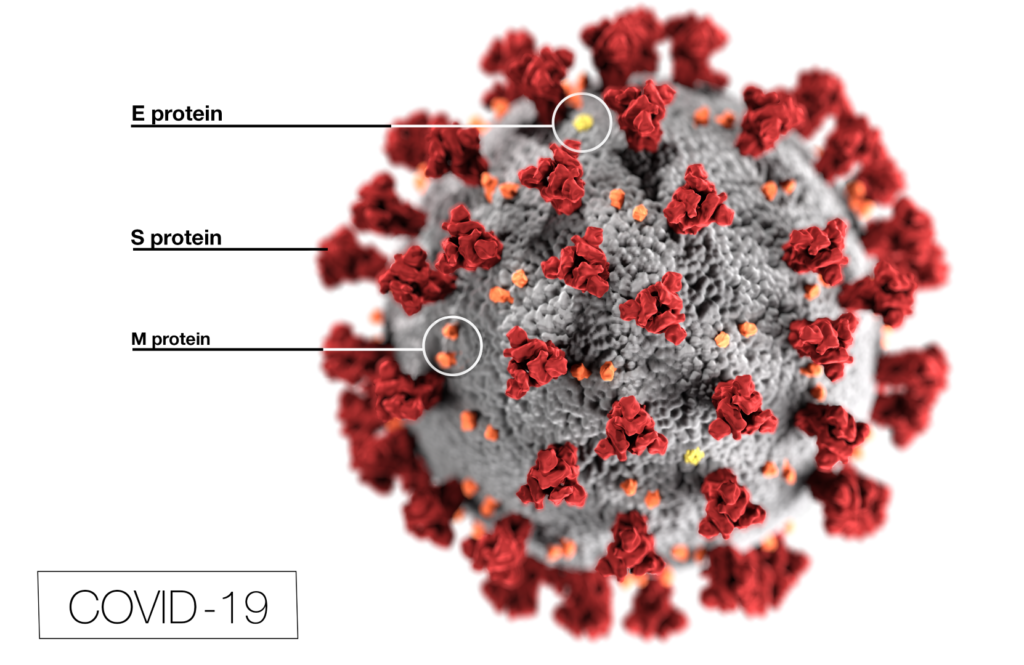

Note: websites dealing with the medical aspects of COVID-19 are found under several of the sites below. This list is intended to offer resources specifically for businesses.

US Federal Government resources:

www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources SBA loan guidance

https://covid19relief.sba.gov/# SBA COVID-19 Economic Injury Loan Application

www.usa.gov/coronavirus Federal government resources with links to CDC, etc.

www.dol.gov/coronavirus Department of Labor (employer guide)

www.Healthcare.gov If health exchanges reopen for those who lose health coverage

www.Medicaid.gov Information about Medicaid healthcare benefits

www.medicare.gov/medicare-coronavirus Information for participants in Medicare

Travel industry and community resources:

https://coronavirus.jhu.edu/map.html Johns Hopkins University World COVID-19 Map

https://ntaonline.com/covid-19-central/ NTA (National Tour Association)

www.asta.org American Society of Travel Advisors

www.nglcc.org/covid19 National LGBT Chamber of Commerce

https://uw.org/211/covid19-resources/ United Way local resources (food/mental health)

Utah Resources (check online for similar websites for other states):

https://coronavirus.utah.gov/ Utah state government coronavirus site

https://coronavirus.utah.gov/business/ Support for Utah businesses

https://jobs.utah.gov Utah Department of Workforce Services (unemployment)

www.slc.gov/ed/elploan/ SLC Emergency loan program

-

- For Salt Lake City business license holders; APPLICATIONS DUE by APRIL 2)